Estate Planning

A Guide to Financial Advice, Planning & Wealth Management

Refine your Estate Planning

Estate planning encompasses the design of how your property will be managed during life and the distribution of that property at death. Its ultimate goal is to create the most efficient and private transfer of your property to heirs at minimal cost.

REDW Wealth is not a law firm, and we do not offer legal advice. We can, however, assist you in making decisions as you create and modify your estate plan over time. From estate planning design to active estate administration, our financial experts can help you deal with inheritance(s), estate administration problems, and the filing of estate and trust income tax returns.

The four major areas to focus on in your Wealth Management process include essential planning for the transfer of wealth, advanced estate planning concepts, minimizing transfer taxes, and charitable planning.

4 AREAS OF ESTATE PLANNING

Basic Estate Planning

Over the past several decades, the estate tax has been eliminated for most individuals and families. As that has happened, emphasis has shifted from the more sophisticated and exotic methods of transferring assets to more basic tools for estate planning. Additionally, much of the planning that was focused on reducing or eliminating estate taxes has shifted to minimizing capital gains and income taxes. At REDW Wealth, our advisors will work with you to discuss how to design plans for you, and your family.

- Wills/TOD/POD

- Beneficiary Planning

- Health Care Directive

- Revocable Trusts

- Durable Power

- Special Needs

- Equalization

- 2nd Marriage

Accounting

Capitalize on opportunities and minimize risks. We will make it easy to focus.

Advanced Estate Planning

Even though estate taxes have been eliminated for most, where they remain, these taxes can devastate the work of a lifetime. Frequently, the estate tax comes into play because a business has been very successful. However, the success that builds the net worth of the owner can also threaten the employment of hundreds, or thousands of individuals because of the burden of transfer taxes. Our trusted advisors maintain expertise in advanced planning ideas for cases like these and will professionally advise on the viability of various planning alternatives.

- IDIT / ILIT

- Dynasty Trust

- Discount Gifting

- GST Planning

- GRAT

- QPRT

Minimize Transfer Tax

In many cases, Congress has helped minimize the transfer for millions of individuals and families across the country. Consequently, you may find that a parent or grandparent is looking for ways to unwind trusts or life insurance policies that are no longer needed in today’s circumstances. REDW Wealth advisors can help you navigate the choices and tax ramifications of exit planning for estate plans that are no longer required or tax efficient.

- Charitable Trusts

- Lifetime Gift

- Estate Freeze

- IRA Ben. Planning

- Credit Shelter

- Annual Giftinge

Accounting

Capitalize on opportunities and minimize risks. We will make it easy to focus.

Charitable Planning

Charitable giving can be motivated by personal desires with the added benefit of tax incentives. However, over the years, we have seen many presentations to donors that focus on tax incentives, rather than your goals, or your relationship to a given charitable cause. In these cases, REDW Wealth can provide consultation for your goals and help identify tax-efficient methods of gifting.

- CRT /CLAT

- Donor Adv Fund

- Private Foundation

- Direct Gifts

- Gift Annuity

Breathe. We’ve got this!

Breathe. We’ve got this!

What makes us so confident? Because at REDW we mean what we say, and we deliver. Bringing a sigh of relief to our clients is the goal we aim for every day and every time we interact with you.

Here at REDW, we’re in the people business. Behind every great organization, new venture, or idea, we know there is a real person with unique goals and ambitions. We believe that understanding human needs and how we can help is the best way to build trust and make our relationship with clients more meaningful, impactful and long-lasting.

Affiliations & Acknowledgements

We actively develop strategic alliances and associations that uphold our vision to be a national provider of premier client services with unique expertise. These partnerships are integral to our purpose of making impactful contributions to the lives of our clients, our communities, and each team member.

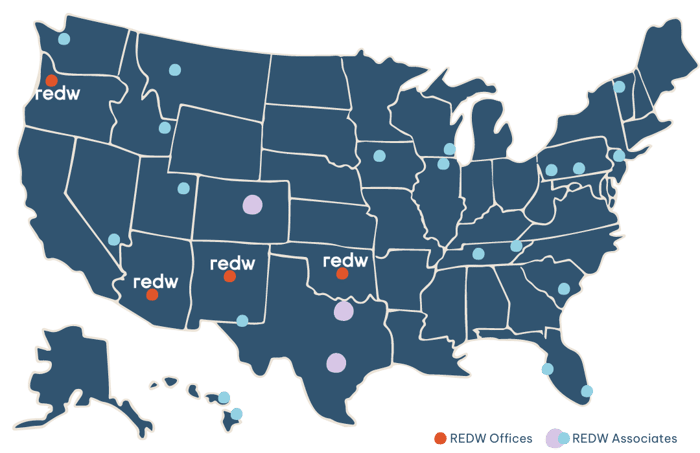

Where You Can Find Us

Whatever your challenges, and wherever you operate, REDW is sure to have skilled and knowledgeable representatives near at hand, ready to help.

"In 2011, we became Private Wealth clients when the firm formed the Private Wealth service. We

are always grateful for our conversations with Paul Madrid and his team. Having that personal

bond as well as a professional one is important, unlike an impersonal relationship with other big

name, larger firms. With REDW, we have the utmost confidence and trust that they put our

interests first, not the firm’s. We have and do highly recommend them to others."

Ready to build a roadmap for your financial future?

Start the conversation by connecting with us today. Or call us at 1-888-416-3292